Shares

Debt information

Debt and financing

The objective of Kalmar treasury management is to secure sufficient funding for business operations, avoid financial constraint at all times, provide business units with financial services, minimise the costs of financing, manage financial risks (currency, interest rate, liquidity and funding, credit and counterparty risks as well as operational risks) and to provide management with information on the financial position and risk exposures of Kalmar and its business units.

Key figures

Net debt

Net debt 31 March 2025, MEUR

|

Loans from financial institutions |

250 |

|

Lease liabilities |

83 |

|

Other interest-bearing liabilities |

10 |

|

Total interest-bearing liabilities |

342 |

|

Loans receivable and other interest-bearing assets |

-3 |

|

Cash and cash equivalents |

-316 |

|

Total interest-bearing assets |

-319 |

|

Interest-bearing net debt |

23 |

|

Equity |

613 |

|

Gearing |

4% |

Liquidity

Kalmar's liquidity and funding position is strong. Table below illustrates Kalmar’s liquidity position.

Liquidity 31 March 2025, MEUR

|

Cash and cash equivalents |

316 |

|

Committed long-term undrawn revolving credit facility |

200 |

|

Liquidity reserve |

516 |

|

Repayments of interest-bearing liabilities in the following 12 months |

-27 |

|

Liquidity |

489 |

In December 2024, Kalmar signed an agreement for a EUR 150 million Finnish commercial paper program. Kalmar may issue commercial papers with a maturity of less than one year within the facility.

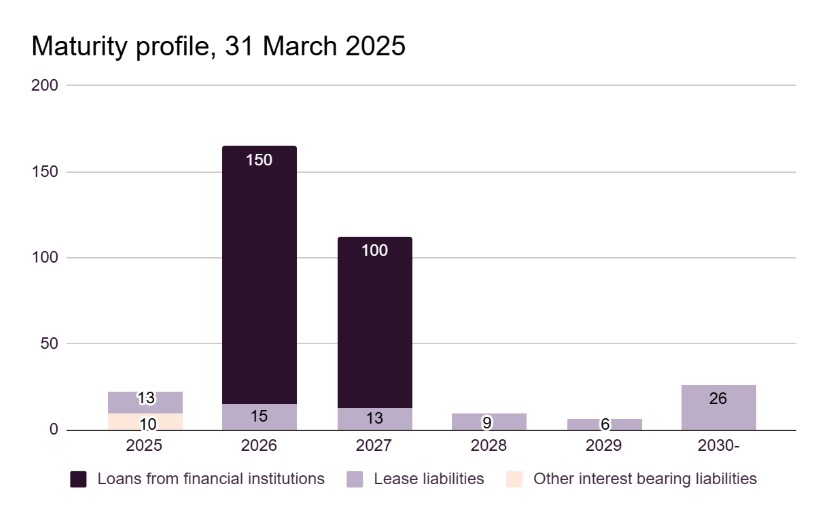

Interest-bearing liabilities

Kalmar held EUR 250 million of loans from financial institutions, EUR 83 million of lease liabilities, and EUR 10 million of other interest-bearing liabilities.

Average interest rate of interest-bearing liabilities excluding on-balance sheet lease liabilities was 3.7%.

Revolving credit facility

In December 2024, Kalmar Corporation entered into a EUR 200 million revolving credit facility with a syndicate of its six relationship banks. The facility has a tenor of five years with two one-year extension options subject to the lender’s approval. The purpose of this facility is to refinance EUR 150 million bilateral revolving credit facilities which would have matured in 2025 and 2027, and general corporate purposes of the group.

Covenants

The financing arrangements contain a financial covenant (net debt to equity), which restricts the capital structure. According to the covenant, Kalmar’s net debt to equity must be retained below 125%.

Credit ratings

Kalmar has not applied for a credit rating from any rating agency.

You need to accept targeting cookies before you can view the YouTube content. Those cookies may be used to show you relevant content and adverts. Click the button “Cookie Settings” to manage your preference.